Accounting for Bills of exchange

ADVANTAGES OF BILL OF EXCHANGE

- It helps in purchases and sales of goods on credit basis.

- It is a legally valid document in the eyes of law. It assures a easier recovery to

the drawer if drawee fails to make the payments.

- A bill can be discounted from the bank before its date of maturity. By

discounting with the bank, drawer can get the money before due date if required.

- It can be easily transferred from one person to another by endorsement.

- It helps in recovery of debt without sending reminders to the debtor.

- It assures the seller about the timely recovery of debt. So a drawer and drawee

can plan about its cash management.

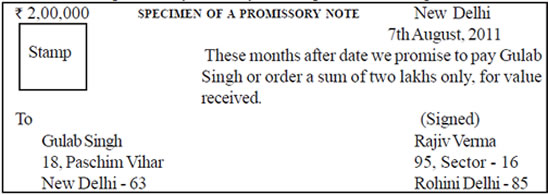

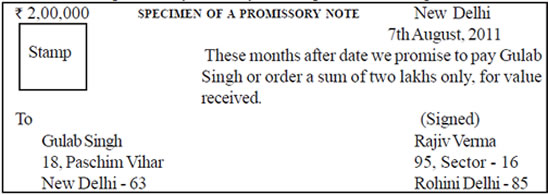

PROMISSORY NOTE

A Promissory note is an instrument in writing (not being a bank note or a currency

note) containing an unconditional undertaking signed by the maker to pay a certain

sum of money only to or to the order of a certain person or to the bearer of the

instrument.

FEATURES OF A PROMISSORY NOTE

- There must be an unconditional promise to pay a certain sum of money on a

certain date.

- It must be signed by the maker.

- The name of the payee must be mentioned on it.

- It must be stamped according to its value.

PARTIES TO A PROMISSORY NOTE

- The maker : The maker is the person who makes the promise to pay the

amount on a certain date. Maker of a bill must sign the promissory note before giving

it to the payee.

- The payee : The payee is the person who is entitled to get the payment

from the maker of romissory note. Payee is the pesson who has granted the credit

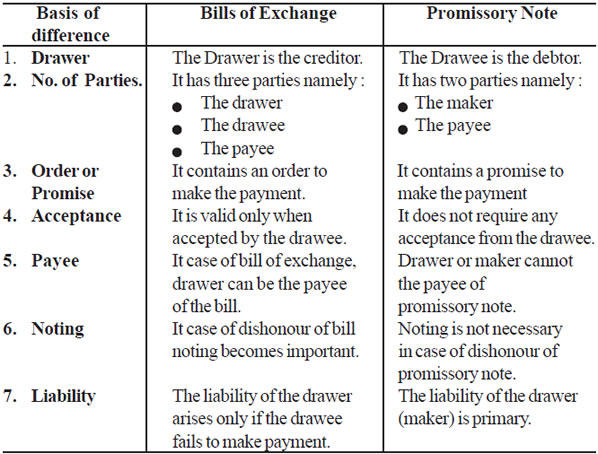

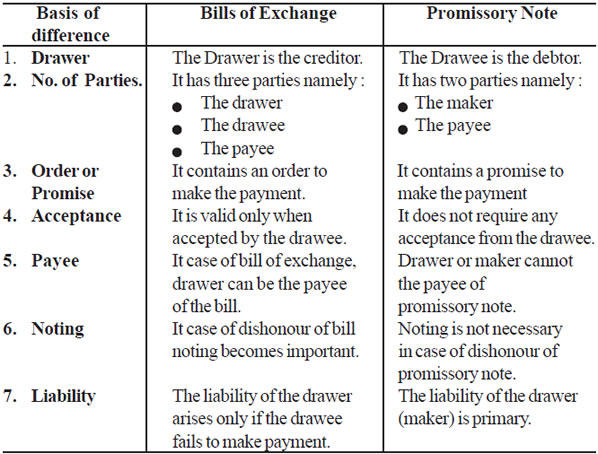

DISTINCTION BETWEEN BILLS OF EXCHANGE AND PROMISSORY

NOTE:-

CBSE Accountancy Class XI ( By Mr. Aniruddh Maheshwari )

Email Id : [email protected]